US Bank Business Credit Card

US Bank, officially known as U.S. Bancorp(parent company) is a bank holding company providing sophisticated banking solutions and products including, mortgage, banking accounts, investments, trusts, payments service products, and many more.

It caters to a wide range of financial structures including business, individuals, government entities and partner financial institutions. Right now, US Bank heralds more about 3,106 branches and 4,842 chains of ATM network. U.S. Bank is also the second oldest constant national charter since the year 1891 as United States National Bank of Portland.

US bank thus relies on its consistency, trust, and ability to bring about changes in the banking experience with the advancement of the technology. US Bank considers itself as the partner to its consumers providing suitable products making their lives safe, convenient and secure. U.S. Bank offers lucrative credit cards catering to various needs.

All About US Bank Business Credit Cards

U.S. Business Credit Cards are tailor-made for the entrepreneur and the spearhead of business to make a significant change in they spend their amount. U.S. Bank is offering small business owners a wonderful opportunity to pick up from their ranges of exclusive Business Cards. Each card is different from each other based on the interest rate, annual fees, terms and conditions, usages, offers and many more.

Right now, the major small business credit cards offered by US Bank are:

- U.S. Bank Business Leverage Visa Signature Card.

- U.S. Bank Flex Perks Business Travel Rewards.

- U.S. Bank Business Select Reward Card.

- U.S. Bank Business Cash Rewards World Elite MasterCard.

- U.S. Bank Business Platinum Card.

To check the details about each of these cards including benefits, rewards and many more, visit, www.usbank.com/business-banking/business-credit-cards.

Eligibility and rules for application

If you are heading a small business, with a decent income pattern and a clean record of debt repayment, you may have a greater chance to apply for any of the above Business Cards. Based on your record and credit history, U.S. Bank sends the potential customers and small business owners Mailing Offers to provide an easier gateway for sure shot approval. U.S. Bank collects these data from the FDIC and strictly chooses the prospective clients to send the mail. The Promotional Mail Offer contains Confirmation Code. With this code, the chances of getting approved for credit card gets higher.

Customers who haven’t received mailers can also apply for the business credit card. Getting a confirmation code does not ensure direct approval. It just makes the chances for approval high. So if you meet the following eligibility criteria, you can easily make the application:

- The applicant must be 18 years or older.

- Applicants must be a legal citizen of the United States of America.

- The applicant must own a business in his/her name.

The detailed procedure for application

During the application, you need to fill up some details. Hereafter, you need to check the suitable cards among the five cards and proceed with your selection:

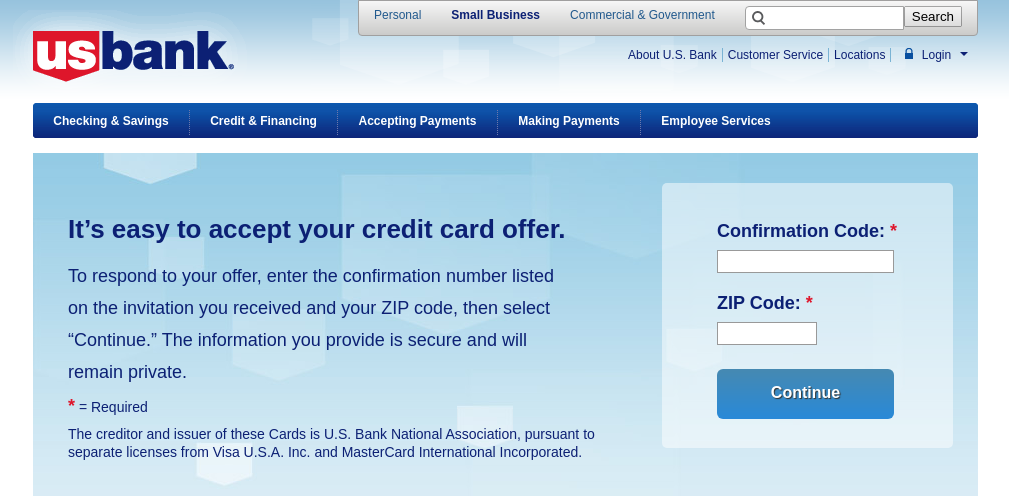

- Applicants, who have received Promotional Mail in their email address or official address, go to www.usbank.com/mybizoffer.

- Enter your Confirmation Code on the mailer.

- Enter the Zip Code of your residential address.

- Click on Continue.

- Applicant s who haven’t received Promotional Mail must visit www.usbank.com/business-banking/business-credit-cards.

- Check the details and the terms and conditions of all the five credit cards.

- Based on your preferred card, click on Apply Now besides the card specifications.

After following the above steps, applicants will be redirected to the Credit Card Application Form. Hereafter, they need to enter the following information:

- First, fill up the details about your business:

- Name of the business/organization.

- Business Name on the Card.

- Business TaxID.

- Full Address of the business location.

- Specify if you want to send the account statement to a different address (residential preferably) instead of the business address.

- Starting year of the business.

- Business Contact Number.

- Gross Annual Sales Figure.

- Legal Structure Data.

- Official Registered name of the business.

- Specify if the production of business is different from the official address for the business location.

- Type of Industry/Sector.

- The country where the business is

- Specify if you need cash advanced via ATM and bank branches.

- Next, the applicant requires to fill up their personal details:

- Business Ownership.

- Full Name.

- Suffix.

- Date of Birth(mm-dd-yyyy)

- Social Security Number.

- Contact Number.

- Email Address of the owner.

- Specify if the personal owner’s address is different from that of the business address.

- Specify if you want to send the account statement to a different address.

- Total Annual Income.

- Percentage of ownership in the business.

- Specify, if you require the balance transfer. If yes, enter the total amount of automatic balance transfer.

- US Bank gives you the option to authorize Business Cards to ten of your employees. If you want to provision your employees with the credit card, select Yes beside Add Employee Cards. You can authorize up to ten employees. You need to enter the employees’ full name, suffix, and social security number, employee date of birth and anticipated expenditure of employees. In case, you want to issue cards to more than 10 employees, you need to call Cardmember Service (contact no. provided at the back of the card),. Once you are approved.

- Check if you have entered all the information correctly. Any discrepancies would lead to the cancellation of the application without further notice.

- Read the Terms and Conditions within the box in detail.

- Check on I accept Terms and Conditions.

- Click the Submit tab.

You will be redirected to the approval page, where you will be informed about application status.

Also Read : Access To Your Valero Credit Card Account

Customer Service Point of US Bank Business Credit Card

- Visit www.usbank.com/about-us-bank/customer-service.

- Scroll and click on Credit Cards.

- Browse through the respective contact channels according to the concerns and medium. Connect with the appropriate channel to resolve your query, request or complaint.

References: